Credit upgraded amid fluid and uncertain backdrop

The ultimate public health costs and economic impact of Covid-19 are at this time unknown. Public health responses have weighed the human cost of intensive care units being overwhelmed and the number of preventable deaths exploding against the jump higher in unemployment, collapse in investment and demand destruction attached to social distancing. Governments have, understandably, chosen life over wealth.

But policymakers have also sought to use their government and central bank balance sheets to cryogenically preserve the structure of their economies over a three to six month period – variously guaranteeing subsidised business loans, providing grants to SMEs and households, underwriting the private sector wage bill, and implementing a range of regulatory and accounting forbearance measures.

Perfect cryogenics appropriately discounted with perfect foresight would leave financial markets relatively unmoved – deferring or missing the first six months of a perpetual stream of earnings is something that might warrant fairly minor market movements. Imperfect cryogenics would see cash flow problems within the affected economies and their trade partners become widespread solvency problems: firm failures abound and the recent weakness in financial markets is just a prelude to a more meaningful collapse that accompanies a synchronised global depression.

While the future is unknown we do know some things about the present.

The first thing we know pertains to valuation. The additional yield above government bonds offered by investment grade corporate bonds has tripled this year from around +100 basis points to around +300 basis points. Fixed income markets at times last week ceased to function and large dislocations attached to bid-less liquidations were abundant.

It was not uncommon to see long-dated investment grade bonds drop ten points one day, then ten points the next; the most important news came in the form of the lack of market depth and the pressure from the seller to raise funds. Backing out what might be priced into market spreads leaves us with an estimate that the market is compensating investors for a c.25% cumulative default rate versus the c.0.5% that typifies investment grade corporate credit. In high yield and emerging market debt we have seen meaningful spread widening and huge negative return numbers and high yield corporate spreads compensate for a c.42% cumulative default rate. These default rates far exceed the maximums so far recorded in any period over the last century. Equity markets have swooned, but have remained functioning, and despite the falls in prices they have outperformed the kind of performance implied by fixed income market movements.

Policy

The second thing we know pertains to policy response. A large fiscal package can cure Covid-19 no more than can a cut in interest rates, the resumption of quantitative easing, daily foreign exchange US dollar swap auctions, or the alphabet soup of liquidity supports from central banks. But these fiscal and monetary programmes can address and ultimately resolve the dislocation seen in fixed income markets. A central bank controls the money supply and can – with enough will – buy every asset in an economy with newly created reserves. While central banks cannot cure the virus, nor might they be able to deliver perfect cryogenics to the economy at large, they do have ultimate control over whether the acute fixed income market dislocations are allowed to throw the financial system into disarray and deliver a second Global Financial Crisis. And they have announced actions of mindboggling magnitude and with stunning speed.

The third thing we know is that the shock to economic activity is going to be enormously large in the short run as sectors of the economy simply shut down. It is not clear yet whether attempts at cryogenics will succeed. As such, the sort of leading economic indicators that we look to have little meaning and feel extremely lagging. Analyst estimates of company earnings have not fallen with the magnitude that our colleagues across the investment department are looking for, but nor are analyst estimates for 2020 seen as important data points – what matters is how the world emerges in 2021-22.

What are we doing with these understandings?

Safely tucked behind screens, portfolio managers talk about “the fog of war” in times of meaningful uncertainty. The phrase resonates, but with real threat to human life all around it sounds flippant. Instead we proceed tentatively based on how we understand the world to have changed, and how financial markets have priced it to evolve. We continue to characterise the Covid-19 pandemic as a serious but temporary shock, and understand that while policymakers will not be able to deliver perfect cryogenics, they have demonstrated a determination to cap discount rates on financial assets and so prevent the public health crisis metastasize into a global financial crisis.

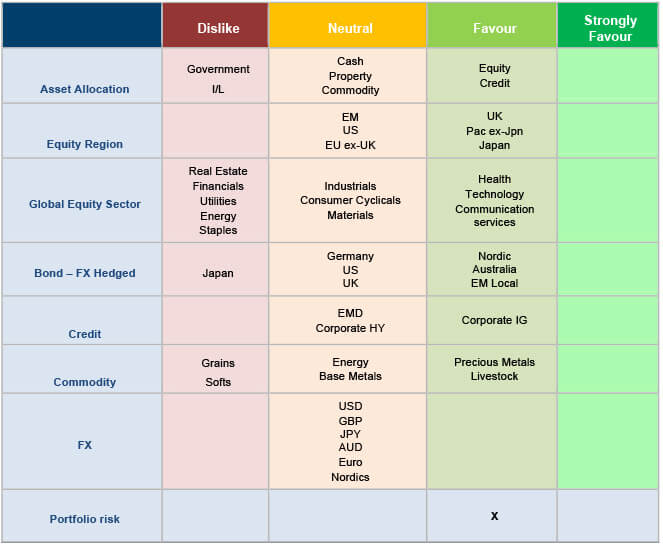

So today we upgraded investment grade credit from neutral to favour, and we also upgraded our Prospective Return to Risk (PRR) score from neutral to favour. All else equal, we will be deploying more portfolio risk with the view that this risk will be compensated with super-normal returns over the next 12 to 18 months. But the situation remains fluid.

As fixed income markets have become dislocated so the absolute volatility of their returns have risen, and the correlation of their returns has shifted higher versus other risk assets such as equities. As such, portfolios with exposure to corporate credit have seen the risk contribution of these credit exposures jump higher, and their aggregate level of portfolio risk jump higher.

In the case of the Dynamic Real Return Fund this has led portfolio risk to move over the past week to levels that today would be targeted (albeit with some opportunistic additions to equity risk). It is disappointing that we are unable to add further risky assets to the portfolio without arriving at an even more upbeat vision of the future.

To do so would require an upgrade of the PRR score to strongly favour – the highest possible setting, and this is something that we have not yet done – uncertainty at this time around the duration of the downturn and the degree to which fiscal authorities can execute their announced plans and keep the economic structures intact hold us back from so doing.

Figure 1: Asset allocation snapshot

Source: Columbia Threadneedle Investment, 26/3/2020.